The recent Fed rate cut has created a buzz across the financial landscape, marking a significant shift in the Federal Reserve’s approach to interest rates. By reducing the federal-funds rate by half a percentage point, the Fed aims to stimulate economic growth while addressing lingering inflation concerns. This cut is particularly beneficial for consumers grappling with high mortgage rates and escalating credit card debts. As borrowing costs decrease, many anticipate an easing in housing affordability challenges, opening doors for more families to enter the market. With further cuts potentially on the horizon, the financial ramifications of this policy shift are set to unfold over the coming months.

In an unexpected maneuver, the Federal Reserve has decided to lower its key interest rate, a trend that many economists believe is crucial for rejuvenating the economy. This interest rate reduction, coupled with the prospect of additional cuts, offers relief for the housing sector, impacting mortgage rates positively. By fostering an environment of lower borrowing costs, consumers can expect increased opportunities for homeownership. Moreover, in an effort to bolster economic momentum, this strategic adjustment aims to address the pressing issue of housing affordability. As such, the implications of this monetary policy shift could reverberate throughout various sectors, influencing everything from consumer spending to investment strategies.

The Impact of the Fed Rate Cut on Consumer Borrowing

The recent Fed rate cut is poised to transform consumer borrowing dynamics profoundly. With borrowing costs decreasing, individuals holding credit card debts are likely to feel immediate relief, as lower interest rates directly influence the cost of debt repayment. Additionally, potential homebuyers may benefit from reduced mortgage rates, enhancing housing affordability and potentially stimulating the housing market. The affordability of monthly payments could empower more consumers to enter the housing market, fostering overall economic growth.

Moreover, this cut by the Federal Reserve not only eases the burden on existing borrowers but also sends positive signals to prospective borrowers. As Jason Furman points out, the expectation of further easing could lead to a sustained downward trend in mortgage rates, making homeownership more attainable for many Americans. This interconnected nature of consumer borrowing and Fed interest rate policies highlights the pivotal role the Federal Reserve plays in shaping financial conditions that impact everyday lives.

Expectations for Future Fed Rate Cuts

As indicated by Fed Chairman Jerome Powell, the central bank is prepared to undertake additional rate cuts in the near future. Current forecasts suggest that two more cuts, each of 25 basis points, could be anticipated by the end of the year, contingent on economic indicators like inflation and employment data. This proactive approach to monetary policy underscores the Fed’s commitment to fostering a favorable economic environment while maintaining a delicate balance to avoid undue inflation or recession.

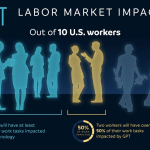

Such expectations are crucial not only for Wall Street investors but also for Main Street consumers. A lower Fed rate indicates to businesses that costs of borrowing are likely to remain manageable, potentially leading to increased investment and job creation. Although immediate impacts on consumer spending might be subtle, the long-term implications of continued Fed rate cuts could manifest through stronger economic growth and improved markets for various consumer loans.

Exploring the Connection Between Fed Rate Cuts and Mortgage Rates

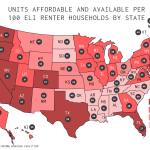

The relationship between Fed rate cuts and mortgage rates is both direct and complex. Typically, a decrease in the federal funds rate leads to lower mortgage rates, enabling borrowers to secure loans at more favorable terms. As the Federal Reserve continues to ease its monetary policy, industry experts anticipate further declines in mortgage rates, which are already responding positively to the recent cut. This trend could significantly aid the ongoing housing affordability crisis experienced across the nation.

However, the effectiveness of Fed rate cuts in alleviating housing issues may vary. While lower mortgage costs can enhance affordability, other market factors such as supply constraints and overall demand for housing also influence the housing market. Therefore, while the Fed’s actions provide essential support, they are one of many elements that determine housing affordability. Long-term solutions will require addressing these underlying market dynamics alongside the effects of monetary policy.

Potential Impacts of Lower Interest Rates on Economic Growth

Lower interest rates are heralded as a catalyst for economic growth, incentivizing both consumer spending and business investments. As borrowing becomes less expensive, businesses are more likely to expand operations, upgrade infrastructure, or hire additional staff, fostering job creation. This influx in economic activity is essential for sustaining an upward trajectory in the economy, particularly in a post-pandemic landscape that relies heavily on resilient growth.

Moreover, reduced borrowing costs can spur consumer confidence, prompting households to increase expenditures on larger items like homes and vehicles. This uptick in consumer spending generally results in a robust multiplier effect throughout the economy, leading to even greater demand for goods and services. Interconnectedly, the overall economic growth propelled by lower interest rates contributes to maintaining employment levels and stimulating further investments across various sectors.

Let’s Discuss the Fed’s Decision to Cut Rates Amid Inflation Concerns

The decision to cut rates amidst persistent inflation concerns raises valid questions regarding the Federal Reserve’s strategy. While lower rates traditionally aim to spur economic activity, the risk of exacerbating inflation can’t be overlooked. Chairman Powell’s remarks hint at a careful recalibration of policy that aims to balance these sometimes conflicting economic goals. This proactive stance signals the Fed’s willingness to intervene should inflation remain manageable, while still nurturing growth in other sectors.

Critically, this balancing act showcases the Fed’s evolving response mechanism to unforeseen economic challenges. By targeting interest rate cuts as a primary strategy, the Federal Reserve aims not only to influence borrowing behavior but to actively shape consumer and business sentiments. Ultimately, the reaction of markets to these conditions will dictate the overall success of the Fed’s approach amidst tumultuous economic landscapes.

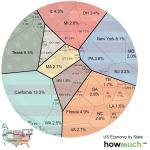

The Role of Economic Indicators in Shaping Fed Projections

Economic indicators play a pivotal role in shaping the Federal Reserve’s projections and, consequently, its monetary policy decisions. Metrics such as inflation rates, employment figures, and consumer spending trends guide the Fed’s actions, aiding in the assessment of the overall economic health. For instance, if job growth shows signs of weakening, the Fed’s inclination to cut rates further becomes more pronounced in order to bolster the economy. This responsive approach is essential for ensuring both short-term stability and long-term growth.

Moreover, the communication of these projections to the public and market participants serves to set expectations for future monetary policy. When signals indicating potential rate cuts emerge, businesses can adjust their strategies in anticipation of lower borrowing costs, thereby maintaining economic momentum. This feedback loop between economic indicators and Federal Reserve actions emphasizes the importance of data-driven decision-making in navigating ever-changing economic landscapes.

Analyzing Inflation and Its Impact on Monetary Policy

Inflation remains a crucial factor influencing the Federal Reserve’s decision-making process regarding interest rates. As inflation rates fluctuate, the Fed must weigh the necessity of cuts against the potential for overheating the economy. With the recent rate cut, Powell noted the Fed’s encouragement by progress on inflation, reflecting a strategic acknowledgment that supporting growth without excessively fueling inflation is a delicate balance.

Furthermore, inflation expectations also guide consumer behavior and business planning. If consumers anticipate rising prices, their purchasing behavior might alter, leading to decreased demand. Thus, the Fed’s commitment to keeping inflation in check while fostering economic expansion is crucial for maintaining consumer confidence. Successfully navigating this complex relationship will be vital for achieving sustained economic growth without triggering undesirable inflation.

Consumer Relief: How Soon Will It Come After the Fed Rate Cut?

The timing of consumer relief following the Fed rate cut is uncertain and varies based on individual circumstances and market conditions. While some immediate benefits are likely, such as lower rates on new loans and mortgages, existing debts may take longer to reflect these changes. Financial institutions often adjust their rates slowly, considering risk factors and anticipated future central bank actions before aligning with the cuts made by the Fed.

Moreover, while consumers are hopeful for rapid changes in their loan terms, the reality is that several variables contribute to the overall landscape of borrowing costs. Factors like creditworthiness, market conditions, and the risk associated with loans all play significant roles in determining how quickly consumers can expect relief. Over time, as the market reacts to sustained policy changes, the gradual easing of rates could provide the relief that consumers have been waiting for.

Federal Reserve’s Influence on Housing Market Trends

The Federal Reserve’s actions significantly influence housing market trends, primarily through its control of interest rates. When the Fed lowers rates, typically, mortgage interest rates follow suit, making homes more affordable to potential buyers. This accessibility can stimulate demand in the housing market, ultimately contributing to improved housing affordability amidst previously rising prices. As noted, a decline in rates can enhance buyer confidence, encouraging home purchases that had previously been postponed.

However, the impact of Fed rate decisions is multifaceted and does not operate in isolation. Factors such as supply chain challenges and changes in buyer demand also shape the housing landscape. Therefore, while the Fed’s rate cuts are beneficial for prospective homeowners, a comprehensive approach involving various economic factors is necessary to tackle the broader housing affordability crisis effectively. Understanding these interconnected aspects is critical for navigating the complexities of the housing market.

Frequently Asked Questions

What is the significance of the recent Fed rate cut by the Federal Reserve?

The recent Fed rate cut, which lowered the key interest rate by half a percentage point, signals an attempt by the Federal Reserve to stimulate economic growth. This reduction in interest rates is expected to lower borrowing costs, benefiting consumers with credit card debt, car loans, and home buyers by potentially reducing mortgage rates.

How will the Fed rate cut affect mortgage rates and housing affordability?

The Fed rate cut is likely to lead to a decrease in mortgage rates, making borrowing cheaper for home buyers. This could alleviate some housing affordability issues as lower mortgage rates can enable more consumers to enter the housing market or purchase homes at lower costs.

Will consumers see immediate benefits from the Fed rate cut on their debts?

Consumers may not experience immediate relief from high interest rates on debts like credit cards and mortgages. While the Fed rate cut can lead to lower borrowing rates over time, it takes a while for these changes to trickle down to consumer rates. For the next few months, rates may remain relatively high.

What is the expected impact of further Fed rate cuts on economic growth?

Further Fed rate cuts, as indicated by the Federal Reserve, are expected to promote economic growth by increasing job creation and encouraging consumer spending. The primary goal is to maintain a balance between stimulating the economy and keeping inflation under control.

How does the Fed rate cut influence Wall Street and Main Street differently?

The Fed rate cut can boost Wall Street by increasing investor confidence and potentially leading to higher stock prices. For Main Street, it may improve access to credit and reduce borrowing costs, thereby enhancing consumer spending and economic activity.

Are there risks associated with multiple Fed rate cuts in terms of inflation?

Yes, with multiple Fed rate cuts, there is a risk that inflation might rise if the economy grows too quickly as a response to lower interest rates. The Federal Reserve must balance these cuts to stimulate growth while keeping inflation within a target range.

How are future Fed rate cuts determined and what impacts their timing?

Future Fed rate cuts are determined by economic indicators such as job reports and inflation data. The timing of these cuts is contingent on how the economy reacts—if the labor market weakens, the Federal Reserve may opt for further rate cuts to support growth.

How do Fed rate cuts impact consumer confidence?

Fed rate cuts typically boost consumer confidence by signaling that borrowing costs will decrease, which can encourage spending and investment. This positive sentiment can further stimulate economic growth as consumers feel more secure in making financial decisions.

What long-term effects can a Fed rate cut have on the economy?

Long-term effects of a Fed rate cut can include sustained economic growth, increased job creation, and higher levels of consumer spending. However, persistent low rates can also lead to asset bubbles if not balanced with appropriate inflation controls.

Is it certain that consumers will see lower mortgage rates following the Fed rate cut?

While lower mortgage rates are likely following the Fed rate cut, it is not guaranteed as other market factors also influence mortgage rates. However, as the Fed continues to ease policy, the expectation is that mortgage rates will trend downward.

| Key Points | Details |

|---|---|

| First Fed Rate Cut in Four Years | The Federal Reserve cut interest rates by a larger than expected half percentage point to lower borrowing costs. |

| Impact on Consumers | Benefits for those with credit card debt, car loans, and potential home buyers, although relief may vary in timing. |

| Future Rate Cuts Expected | Two more possible cuts by the end of the year as indicated by Fed Chairman Jerome Powell, contingent on economic data. |

| Effect on Mortgage Rates | Mortgage rates are expected to decline further, helping housing affordability despite previous highs. |

| Economic Growth Outlook | Potential for slight job creation and economic growth over the next 6 to 12 months, albeit with some inflation. |

| Concerns for Future Rates | Consumer debt repayment is taking longer, and it’s uncertain when rates will significantly decrease. |

Summary

The recent Fed rate cut is a pivotal development for consumers, signaling potential benefits but with uncertainties regarding the exact timing of relief from rising interest rates. As the Federal Reserve continues to adjust its monetary policy, consumers may find some respite in borrowing costs, particularly related to mortgages and loans. However, the pace of improvement in their financial situations remains unclear, underlining the importance of monitoring future Fed actions.