The impact of China tariffs is poised to reverberate through multiple sectors of the U.S. economy, potentially altering the landscape of international trade relations. As President-elect Donald Trump prepares to reinstate strict tariffs on Chinese imports, experts warn that this move could lead to higher prices for American consumers, echoing the challenges faced during the previous administration. Supply chain disruptions may arise as manufacturers grapple with increased costs and sourcing complexities, further complicating existing trade dynamics. Meanwhile, these tariffs could also influence Beijing trade relations, allowing China to forge closer ties with U.S. allies, thus impacting global trade implications. Economists are closely monitoring these developments, highlighting the delicate balance between protecting domestic interests and fostering a cooperative global trade environment.

Exploring the ramifications of imposed tariffs on Chinese goods reveals critical interactions within international markets and domestic economies. This trade policy, advocated by Trump, suggests a retrenchment in U.S.-China transactions that may disrupt established supply chains and escalate trade tensions further. The elevated costs associated with Chinese goods could kindle inflationary pressures in the United States, compelling businesses and consumers to rethink spending habits. These tariff policies not only threaten the flow of goods but also redefine the geopolitical landscape, fostering an environment where strategic alliances may shift dramatically. Such a scenario raises pertinent questions about how countries adjust their economic strategies in response to significant tariff measures.

The Impact of China Tariffs on the US Economy

The potential imposition of tariffs on China, as outlined by President Trump, carries significant risks for the US economy. While the intention behind these tariffs might be to protect American jobs and industries, they can lead to increased prices for consumers and disrupt existing supply chains. Economists warn that when tariffs are placed on Chinese imports, American companies that rely on these goods face higher costs. This often trickles down to consumers, who ultimately bear the burden of increased prices on everyday products. A direct correlation can be drawn between tariffs and inflation, highlighting that while some sectors might benefit, the overall consumer experience could be negatively impacted.

Additionally, the imposition of China tariffs might incite retaliatory measures from Beijing, further complicating trade relations. Such retaliation could exacerbate tensions, leading to a trade war that disrupts not only US-China trade but also the global supply chain. This disruption has broad implications, impacting a range of industries from electronics to agriculture. As companies scramble to find alternative suppliers or adjust production strategies, they may face delays and increased operational costs, thus straining their ability to remain competitive in a global market. The focus must shift from short-term gains to understanding the long-term repercussions of these tariffs on the US economy.

Global Trade Implications of Tariffs

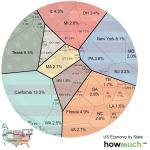

The imposition of tariffs extends beyond national borders, carrying profound implications for global trade dynamics. As the United States prepares to enact steep tariffs on Chinese imports, the ripple effects are likely to be felt across multiple economies. Countries that have established trade relations with both the US and China may find themselves caught in the crossfire, struggling to navigate the complexities of diverging trade agreements and policies. This can lead to significant shifts in global supply chains as companies reassess where to source their materials and products, potentially causing instability in other markets as manufacturers relocate.

Moreover, this strategy could lead to increased trade tensions not only between the US and China but among other trading partners as well. Countries in Europe, Asia, and beyond could react to US tariffs by forming new alliances and trading blocs, aiming to mitigate the impact of US trade policies. As nations jockey for position in a shifting trade landscape, the global economy may become more fragmented, challenging the principles of free trade and cooperation that have historically fostered economic growth. It raises critical questions about the future of international trade agreements and whether countries will rally around the US, China, or forge their own paths.

Supply Chain Disruptions and Labor Market Effects

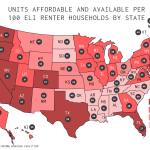

In the wake of potential tariffs, supply chain disruptions become a pressing reality for many American businesses. The complexity of global supply networks means that changes in trade policy can have far-reaching effects. For instance, if tariffs are imposed on Chinese goods, US companies that depend on components manufactured in China may struggle to find alternative suppliers in a timely manner. This can lead to production delays, a shortage of goods, and ultimately a hit to revenue as businesses grapple with unanticipated increases in costs and timeframes.

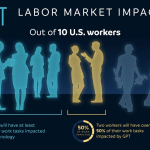

Labor markets may also feel the consequences of a burgeoning trade war. Industries heavily reliant on exports may be forced to cut jobs if tariffs disrupt their ability to compete internationally. Additionally, as companies adjust their sourcing strategies in search of cheaper alternatives, this could lead to increased competition for labor in industries that are still thriving, essentially creating a labor shortage in certain sectors while others are shedding jobs. This imbalance could stress the labor market, further complicating economic recovery efforts in the wake of the pandemic.

Beijing’s Strategic Trade Responses

In anticipation of potential tariffs, Beijing is likely to devise strategic responses aimed at mitigating the negative impacts on its economy. Historically, China has demonstrated resilience in the face of trade pressures, often employing a combination of diplomatic efforts and economic adjustments to counteract adversity. By fostering stronger ties with other trading partners such as the European Union and Southeast Asian nations, China may seek to diversify its export markets and reduce its reliance on the US. This strategic pivot could reinforce China’s global standing and diminish the economic impact of US tariffs.

Additionally, a recast focus on encouraging domestic consumption might become a hallmark of China’s response strategy. While the nation’s economy has long been driven by exports, propelling a consumer-driven market could buffer against the shocks of reduced demand from the US. By fostering a robust internal market, China could mitigate some of the adverse effects of tariffs, potentially transforming the current crisis into an opportunity for economic reform. Such measures not only showcase China’s adaptability but also indicate a strategic recalibration that could reshape global trade relations.

Long-Term Economic Outlook Amid Tariff Threats

The long-term economic outlook for the United States amidst the looming threat of tariffs paints an uncertain picture. While there might be short-term advantages seen through increased tariffs on imports, the prolonged impact could be detrimental to both domestic and international markets. Experts warn that sustained high tariffs could stifle domestic innovation and competitiveness, leading to a decline in economic growth. As businesses struggle with increased costs, they may cut back on investments in technology and workforce development, setting a troubling precedent that could hinder economic progress.

Furthermore, the evolving landscape of international trade means that traditional allies may start to reconsider their partnerships in light of US tariffs. As shifting allegiances come into play, the US could find itself in a precarious position, losing out on vital opportunities for collaboration and joint ventures. Trade relationships built over decades stand at risk of being unraveled, potentially leading to a complete restructuring of international trade dynamics. The long-term implications could involve a blend of economic isolation and increased vulnerability as other nations build alliances that counter US interests.

The Rise of Alternative Markets in Response to US Tariffs

As the US considers imposing hefty tariffs on Chinese products, alternative markets begin to emerge as potential beneficiaries in a shifting global landscape. Countries like India and Vietnam present themselves as viable options for businesses seeking to relocate their supply chains in response to the unpredictability of US trade policy. These nations possess untapped potential for manufacturing and could attract investment by offering cost-efficient solutions and a burgeoning labor force. However, the transition is fraught with challenges, as it requires considerable time and investment to develop the necessary infrastructure and technical capabilities.

Moreover, the prospect of alternative markets gaining ground is not merely about filling the void left by China; it’s about a broader reconfiguration of trade networks. As companies evaluate new sourcing options, we may see a diversification of supply chains that establish a more resilient global trade structure. This shift can potentially reduce the overreliance on any single country, promoting a healthier balance in global commerce. The emergence of alternative markets signals not just a response to tariffs but an opportunity for transformation that could redefine the nature of international trade for years to come.

Negotiation Strategies Amid Tariff Uncertainties

The uncertainties surrounding the looming tariffs have prompted both the US and China to reconsider their negotiation strategies, especially in light of the historical context of US trade relations. With President Trump’s strong rhetoric urging tougher stances on trade, Chinese officials may feel compelled to adjust their approach to engage in constructive dialogues that prevent further escalation. This could potentially lead to a more nuanced relationship between the two nations, reflecting a mutual understanding of the need to stabilize economic ties that have been strained over time.

However, the effectiveness of these negotiation strategies largely depends on the willingness of both parties to embrace compromise amidst rising tensions. As tariffs threaten to reshape the economic landscape, the scope for diplomatic engagement becomes increasingly critical. China may leverage these negotiations to address its own economic vulnerabilities while simultaneously seeking to mitigate the impact of US tariffs. This situation could provide a unique opportunity for both nations to reassess their priorities and seek collaborative solutions, highlighting the importance of sustained dialogue in an increasingly polarized trade environment.

Strategic Alliances in Response to Trade Tensions

With the prospect of intense tariffs on Chinese imports, the landscape of international trade alliances is poised for transformation. Countries that have been historically friendly to the US may begin to forge stronger ties with China to counterbalance trade tensions. This strategic alignment could lead to a coalition of nations willing to collaborate on common economic interests, thereby diminishing the effectiveness of the unilateral tariffs imposed by the US. Such alliances could threaten the traditional dominance of US trade policies and showcase a shift toward multipolarity in global economic governance.

Moreover, this possibility of new alliances underscores the interconnectedness of today’s economies, where decisions made in one part of the world ripple across borders. As countries seek to protect their trade interests, they might engage in forming trade agreements that circumvent US tariffs, cultivating a more diverse and competitive global marketplace. In light of these developments, the ability of the US to maintain its leadership in global trade could be challenged, necessitating a reevaluation of its current policies and practices in an era defined by collaboration and interdependence among nations.

Frequently Asked Questions

What is the impact of China tariffs on the US economy?

China tariffs, particularly those proposed at 60% or higher, could significantly increase prices for American consumers, leading to inflation and reduced purchasing power. This could trigger supply chain disruptions, affecting various sectors reliant on Chinese goods, ultimately hampering economic growth in the US.

How do China tariffs influence Beijing’s trade relations with the US?

The imposition of China tariffs can worsen Beijing’s trade relations with the US by escalating tensions and resulting in retaliation. This breakdown in relations can complicate negotiations and diminish mutual economic benefits, potentially leading to a prolonged trade war.

What are the potential global trade implications of increasing China tariffs?

Increasing China tariffs could reverberate throughout global markets, leading to disruptions in established supply chains. Countries reliant on Chinese exports may face economic setbacks, and this could open up opportunities for competing nations to fill the supply gap, reshaping global trade dynamics.

How might Trump tariffs affect supply chain disruptions in the United States?

Trump tariffs on Chinese imports could exacerbate supply chain disruptions by imposing higher costs on goods and creating uncertainty. Businesses may struggle to adapt quickly, leading to delays and price increases that could ultimately affect consumers and the broader US economy.

Can China counteract the impact of US tariffs on its economy?

While China has been strategizing to mitigate the effects of US tariffs, the complex interdependencies in global trade make it challenging. Beijing could seek to enhance relations with other markets through initiatives like the Belt and Road Initiative, but US tariffs still pose a significant threat to its economy.

Which countries might benefit from reduced Chinese imports due to US tariffs?

Countries such as Vietnam and India might benefit from reduced Chinese imports in the US, as they could potentially attract investment and fill the demand gap. However, building competitive supply chains takes time, and these countries face challenges in matching China’s manufacturing capabilities.

What is the long-term risk of China tariffs on US-China relations?

Long-term risks of implementing high China tariffs include deepening economic divisions and reducing diplomatic ties between the US and China. Such measures could also push China to strengthen alliances with other countries, potentially reshaping international relations and trade flows.

How can American consumers expect to be affected by increased China tariffs?

American consumers may experience higher prices for a variety of products due to tariffs on Chinese imports. This inflationary pressure could lead to decreased spending power and altered consumer behavior, ultimately impacting economic recovery.

What are the expected outcomes for supply chains if China tariffs are enforced?

If China tariffs are enforced, businesses may seek to diversify their supply chains away from China to avoid high costs, leading to temporary disruptions as they reestablish logistics with alternative suppliers. This transition can create short-term challenges but may foster longer-term resilience in global supply chains.

How do tariffs on China relate to the concept of a currency war?

Tariffs on China could escalate tensions that lead to a currency war, where countries manipulate their currency values to gain competitive trade advantages. This could further destabilize international markets and create complex challenges for global economic stability.

| Key Point | Details |

|---|---|

| 1. Potential Impact of Tariffs on US Economy | Imposing tariffs could increase consumer prices in the U.S., disrupt supply chains, and lead to labor shortages. |

Summary

The China tariffs impact can create significant repercussions for both the U.S. and China economies. While aiming to curb trade and political tensions, high tariffs may backfire by causing higher prices and instability in supply chains, ultimately affecting American consumers negatively. Moreover, pinning China into the corner could provide an unexpected opportunity for Beijing to strengthen ties with traditional U.S. allies, potentially redefining global trade dynamics.